Managing payroll and attendance is one of the most critical yet error-prone functions in HR. Manual processes, spreadsheets, and outdated systems often lead to mistakes in salary calculations, compliance issues, and employee dissatisfaction. That’s where an advanced HRMS like PeopleHR India comes in—streamlining operations, minimizing errors, and ensuring accuracy in every step.

Common Payroll & Attendance Challenges

Before diving into how HRMS helps, let’s look at the typical issues companies face:

- Manual entry mistakes in attendance records.

- Incorrect overtime calculations or leave adjustments.

- Delays in salary processing due to mismatched data.

- Compliance risks arising from wrong deductions or tax errors.

- Employee dissatisfaction when salaries don’t match expectations

These issues not only affect productivity but also damage employee trust.

How PeopleHR India HRMS Reduces Payroll & Attendance Errors

1. Automated Attendance Tracking

With biometric or web-based check-ins, PeopleHR India automatically records employee attendance. This eliminates manual punch-in errors, prevents buddy punching, and ensures accurate working hours are captured.

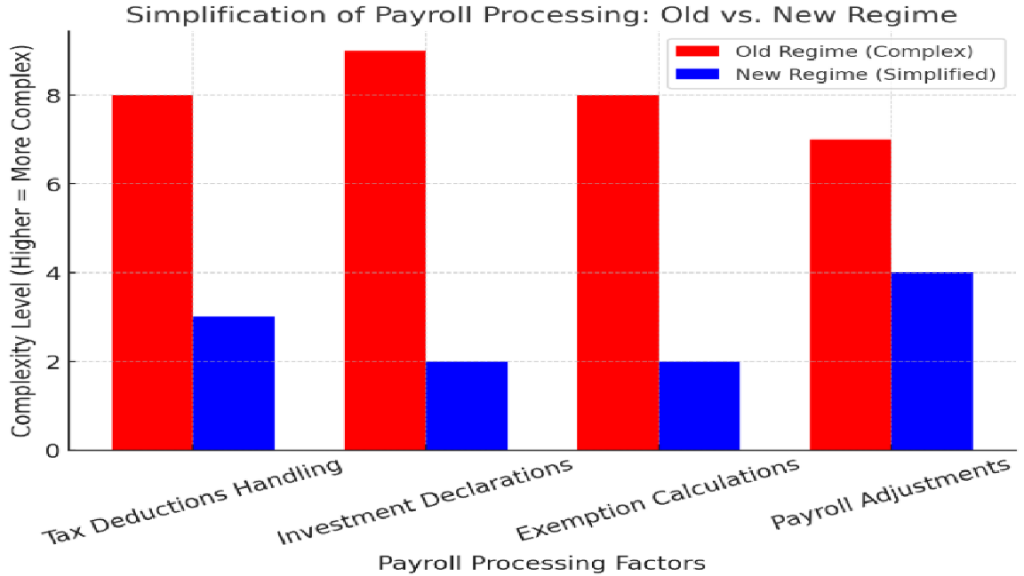

2. Seamless Payroll Integration

Attendance data is directly integrated with the payroll system. No need for manual data transfers, which significantly reduces the chance of errors in salary calculations.

3. Leave & Overtime Accuracy

The system automatically factors in leaves, holidays, and overtime hours. This ensures employees are paid correctly for the time they work and the leaves they take, avoiding disputes.

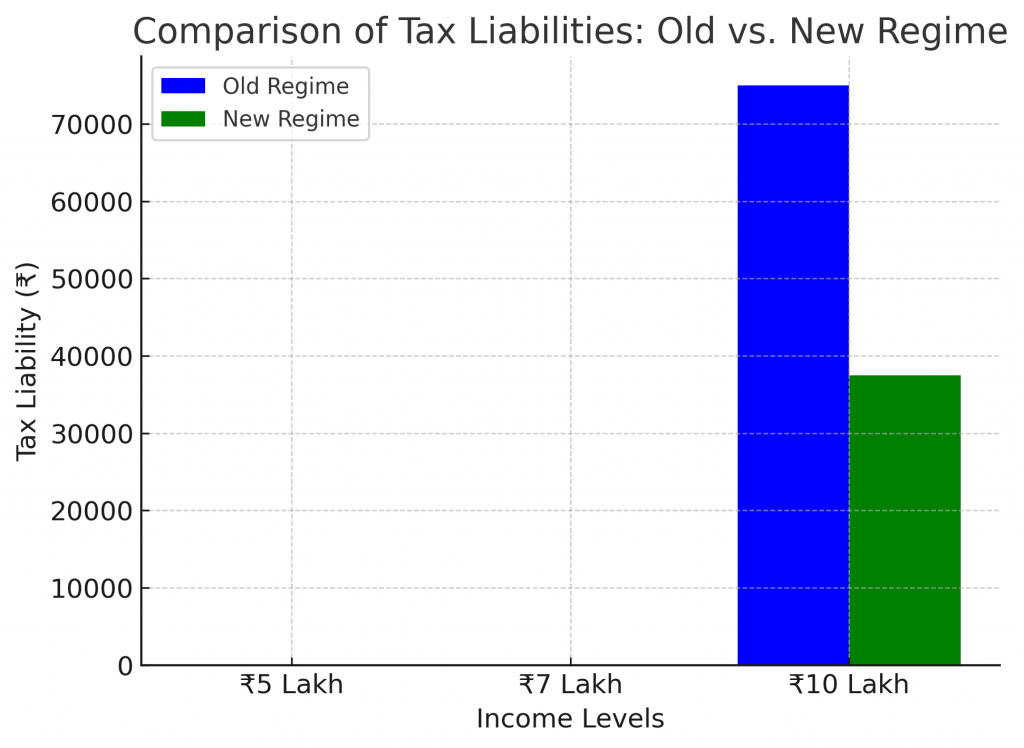

4. Compliance Management

PeopleHR India is designed to handle statutory compliances like PF, ESI, TDS, and other local laws. By automating deductions and filings, the HRMS minimizes compliance errors and keeps organizations audit-ready.

5. Real-Time Insights & Reports

HR teams can access real-time dashboards and reports for attendance, payroll, and leave data. This transparency not only reduces errors but also helps in making data-driven decisions.

6. Self-Service for Employees

Employees can view their attendance, apply for leaves, and download payslips directly from the portal. This reduces HR’s workload and ensures fewer misunderstandings.

Benefits for Organizations

- Time Savings: No more repetitive manual entries.

- Cost Reduction: Fewer penalties due to compliance errors.

- Higher Employee Trust: Accurate salaries build confidence.

- Scalability: Easily manage payroll & attendance for growing teams.

Payroll and attendance errors can be costly—for both finances and employee morale. By using PeopleHR India, organizations can automate and streamline their HR operations, ensuring accuracy, compliance, and efficiency. It’s a smarter way to manage workforce data while keeping employees happy and HR stress-free.