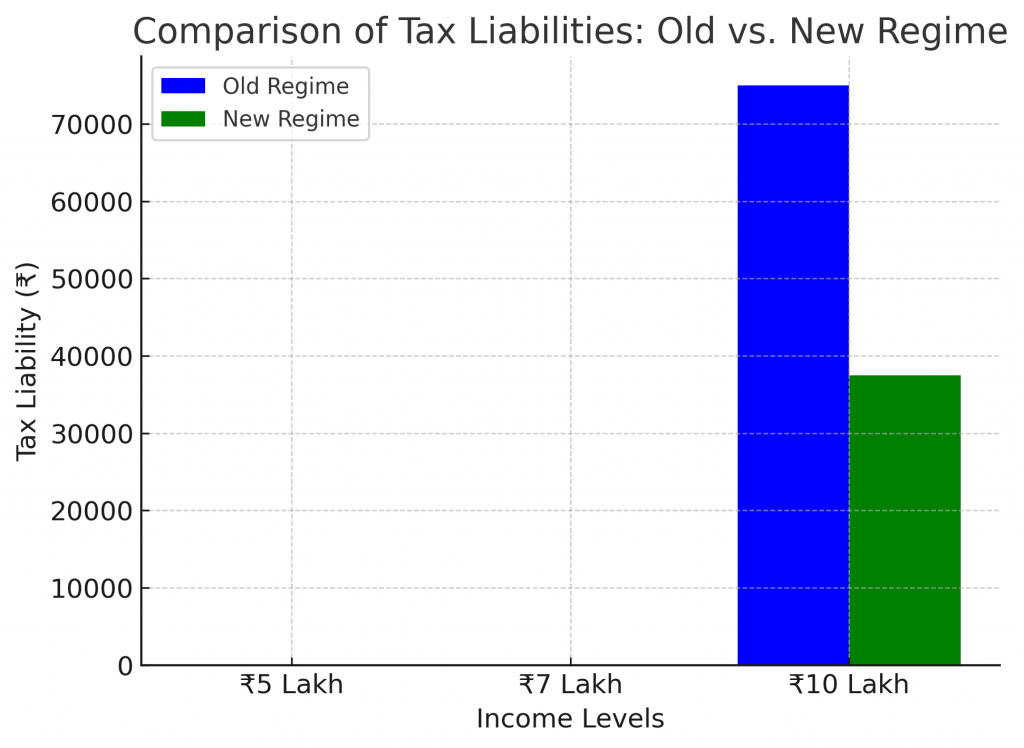

The latest commotion regarding the “No Tax Up to 12 Lakhs” rule in India’s new tax system for FY 2025-26 has employers as well as employees struggling with complicated tax systems. Complying with constantly changing government mandates and running payroll processes with ease is a major challenge for organisations. This is where PeopleHR India HR Software takes over as the definitive solution, streamlining tax compliance, payroll processing, and government reporting with unmatched ease of implementation.

Why Tax Compliance is Important for Businesses?

Compliance with India’s tax laws can be tedious, with frequent changes in exemptions, deductions, and slabs. Non-compliance can result in penalties and financial losses. For employers, it is important to ensure that employees get the right tax deductions while meeting government requirements to steer clear of legal and financial traps.

How PeopleHR India HR Software Facilitates Smooth Tax Compliance?

PeopleHR India HR Software makes all tax complexities manageable with ease while keeping employers and employees up-to-date with the most recent government regulations. This is how it works:

1. Automated Calculations of Payroll Tax

It takes too much time and effort to perform payroll deductions, tax calculations, and compliance manually. PeopleHR India simplifies payroll processing while accurately calculating:

- Income Tax as per the latest slabs

- Professional Tax (PT) deductions

- Employee Provident Fund (EPF)

- Employee State Insurance (ESI)

- Labour Welfare Fund (LWF)

This automation ensures compliance with government norms while eliminating manual errors.

2. Effortless Government Filings and Reports

With timely filing of tax requirements, PeopleHR India produces automatic reports and e-filings for:

- TDS (Tax Deducted at Source) submissions

- Form 16 generation for employees

- EPF & ESI compliance filings

- GST-related payroll requirements

This ensures that businesses stay ahead of deadlines and avoid penalties.

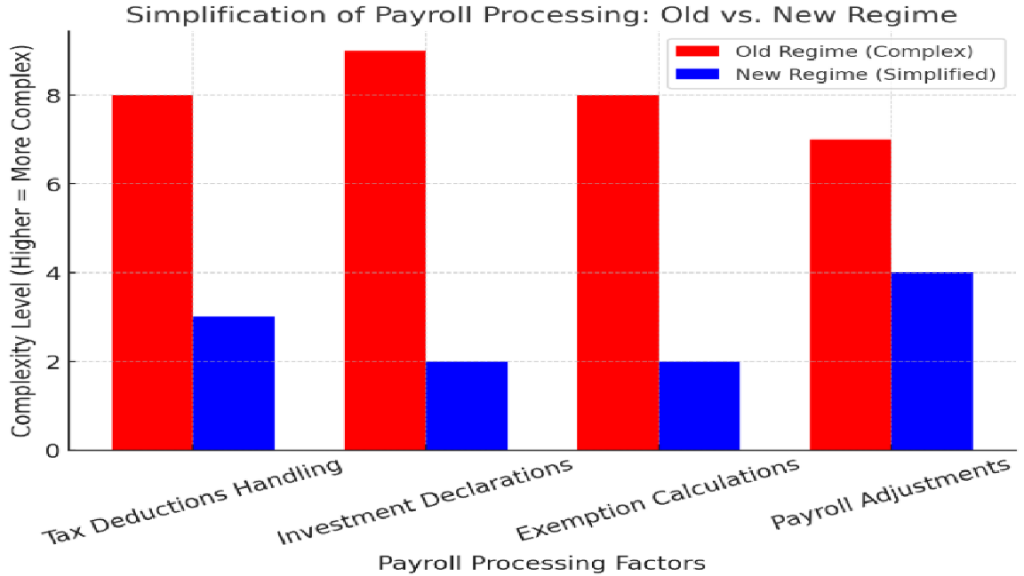

3. Customizable Tax Rules for Every Employee

PeopleHR India realizes that various employees carry various tax implications. The software features adjustable tax settings according to:

- Salary structure and components

- Investment declarations

- Exemptions under sections 80C, 80D, HRA, LTA, etc.

With real-time tax updates, both employers and employees can see their deductions and maximize tax-saving potential.

4. Seamless Integration with Payroll and Accounting

To offer a trouble-free payroll experience, PeopleHR India integrates perfectly with accounting and financial systems to ensure seamless reconciliation of wages, tax withholdings, and statutory payments. This reduces manual entry, errors, and improves financial transparency.

5. Real-Time Compliance Updates

With regular changes in taxes, compliance is paramount. Tax laws are updated automatically by PeopleHR India in the system, and hence companies don’t need to worry about old tax rates or compliance.

Enabling Employees through Self-Service Capabilities

PeopleHR India is more than employer benefits alone—it also enhances employees by giving them:

- A Self-Service Portal to access salary slips, tax deductions, and Form 16

- Investment Declaration Options to optimize tax savings

- Automated Tax Estimations for better financial planning

Why Choose PeopleHR India for Tax and Compliance Management?

✔ Accuracy & Compliance: Eliminates errors and ensures compliance with the latest tax regulations.

✔ Time-Saving Automation: Reduces manual effort and simplifies payroll tax management.

✔ Seamless Integration: Connects with financial and accounting systems for smooth operations.

✔ User-Friendly Interface: Provides easy-to-use dashboards for both employers and employees.

✔ Reliable Support: Expert assistance for all payroll and tax-related queries.

Tax compliance nightmares are a thing of the past. With PeopleHR India HR Software, organizations can automate payrolls, check tax deductions with precision, and keep up to date with changing government regulations seamlessly. As either an employer wanting compliance guarantee or an employee requiring tax transparency, PeopleHR India is your easy solution for carefree payroll and tax management.

Stay compliant, remain stress-free—select PeopleHR India today!